In our research report Customer Experience: The Claim Handler’s Perspective, we asked home insurance claims handlers about the challenges they face throughout the claims process, including the factors that cause delays and the specific needs of their customers.

Home claims present unique challenges when it comes to document handling, communication, and process efficiency. Addressing these areas can lead to smoother, faster claims handling and happier customers.

Challenges faced by home claims handlers

Compliance and reporting

61 % of home claims handlers find compliance and reporting to be tedious, suggesting that the current systems in place for compliance are cumbersome and time-consuming.

Reviewing and processing claims documents and evidence

46% of the handlers struggle with the manual review and processing of documents, pointing to a need for improved document management systems.

Lengthy approval processes

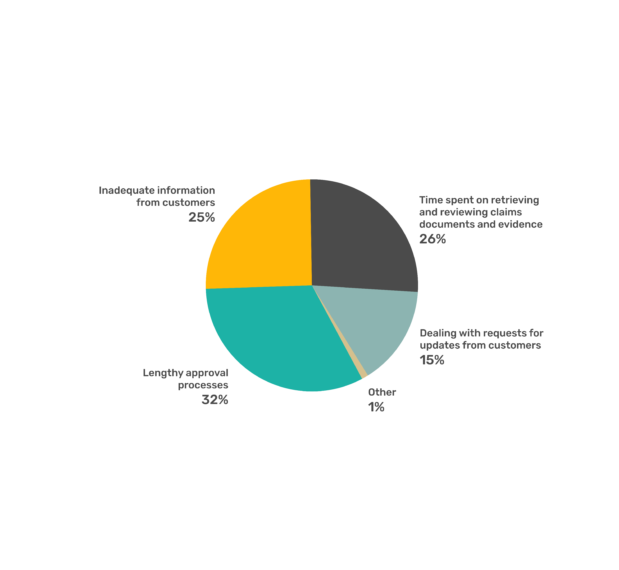

32% of respondents found that lengthy approvals contribute to delays in claim processing, highlighting inefficiencies in internal workflows.

Time spent retrieving and reviewing documents

26% of home handlers spend a considerable amount of time on document handling, suggesting that better document retrieval and review systems could reduce delays.

Areas for Improvement

Customer feedback – Complaints about delays

This is one of the most common types of feedback, with 31% of home claims handlers saying they received it.

Improving customer satisfaction

39% of home claims handlers feel that speeding up the claims resolution process would improve customer satisfaction.

Why home insurance claims are suited for automated claims processing

Home insurance claims present many challenges that make them particularly suited for automated processing.

Automation can enhance efficiency, accuracy, and customer satisfaction by managing complex data and customer interactions, especially during stressful times. Automated systems can handle routine tasks, allowing claims handlers to focus on providing empathetic support and clear communication to homeowners.

Home insurance claims include a number of different documents and data points

– Claims require the verification of multiple documents like property damage reports, repair estimates, and policy details.

– Claims handlers interact with customers, contractors, and legal representatives.

Home insurance claims often involves rule-based processing

– Many features of home insurance claims can be handled using rules and logic. Automated systems can apply these rules consistently and impartially, ensuring fair and accurate claims processing.

Standardised home claim types

– Home insurance claims often fall into predictable categories such as water damage, fire damage, theft, or liability. Each type of claim has well-defined procedures and documentation requirements, making them easier to automate.

The benefits of automating home insurance claims processing

– Efficient data handling: Automated systems quickly scan, verify, and process large volumes of documents, such as property damage reports and repair estimates.

– Error reduction: Automating data entry and validation minimises the risk of human error, ensuring accuracy in claims processing.

– More time for customer support: By reducing the manual workload, claims handlers can spend more time providing empathetic support and clear communication to homeowners.

– Clear information from the start: Automation ensures that any missing information is identified and communicated promptly, reducing delays.

– Streamlined workflows: Automated systems streamline approval workflows and track progress in real-time, ensuring that each step of the claims process is efficient and transparent.

– Faster approvals: Automating routine checks and approvals reduces processing time, allowing homeowners to receive their claims settlements more quickly.

– Fewer challenges in information gathering: Incomplete submissions can complicate communication and information gathering; automation helps ensure all necessary information is collected upfront.

– Intelligent data extraction: AI can extract and interpret data from documents in various formats, enhancing the accuracy and speed of information processing.

How Sprout.ai processes home claims

Sprout.ai uses your home claim handling philosophy to deliver the best possible outcome for both insurers and customers, achieving 98% accuracy often within seconds. This allows claims handlers to focus on complex claims that require a human touch and high levels of expertise.

- Claim classification

The claim is initially classified to understand its nature. For example, in the case of a home insurance claim, it might involve incidents such as water damage, fire damage, theft, or natural disasters. This step sets the stage for detailed investigation and flags any missing information that may be crucial for processing.

- Cause analysis

The cause of the claim is thoroughly analysed. For instance, if the claim is for water damage, the analysis will determine whether the damage was due to a burst pipe, a natural flood, or other unforeseen events. This helps in establishing liability and understanding the context of the incident.

- Assessment

The severity of the incident is assessed. This includes evaluating the extent of structural damage for property claims, the value of stolen items for theft claims, and the cost of repairs for damage claims. This step ensures that the claim is accurately quantified and that necessary interventions are identified.

- Inclusion checking

The claim is then checked for coverage under the customer’s specific home insurance policy. The process involves verifying policy details to ensure the incident is covered. Verification can be conducted using Natural Language Processing (NLP) to interpret the terms directly from the policy document.

- Exclusion verification

Potential exclusions are reviewed to ascertain if the claim falls under any policy exclusions. This step is crucial to ensure that claims are not wrongfully processed or denied. Like inclusion checking, this can be achieved via a digital system or through an NLP review of the policy document.

- Special terms

Any special terms related to the policy are examined which could include unique inclusions or exclusions that are not typically covered in the standard policy language and are often stored in an unstructured format. This ensures all conditions and clauses of the policy are considered and can also be facilitated through digital systems or NLP.

- Settlement

Finally, the appropriate payment is calculated based on the outcomes of the above steps. Advanced deep learning algorithms can be employed to align the settlement with the insurer’s claims handling philosophy, ensuring accuracy and fairness in the compensation provided. This allows claims handlers to allocate more time to complex cases that require more detailed attention.

Conclusion

Sprout.ai addresses common pain points in home insurance claims handling. Through the use of advanced AI technologies such as OCR and NLP, it makes it simple to deal with high volumes of customer communication, time-consuming claims processing, and delays in claim resolutions.