Last month, we introduced an exciting new pilot project that was just getting underway with a major European insurance provider. Let’s check in for a progress update on how our automated solutions will help to bring clarity and speedy resolution to automotive insurance claims, while improving identification of potentially fraudulent submissions.

Over the course of the 12 week pilot, Blockclaim’s technology saved the insurer an incredible €1.5 million euros through a combination of efficiency gains through automation and improving the levels of fraud detection. Let’s find out more.

A uniform approach to automotive claims

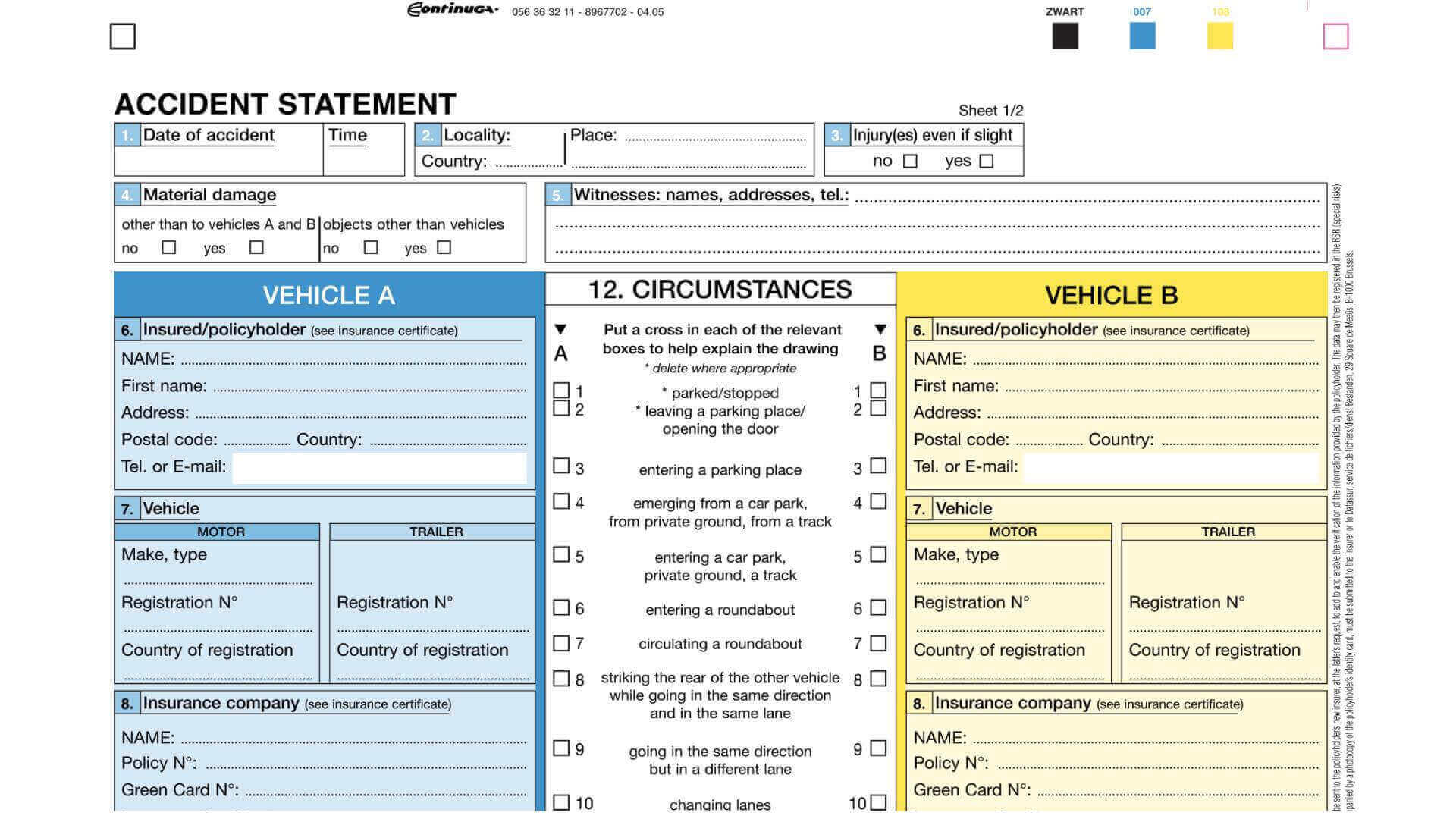

The European accident forms being used today are the same across the continent. This standardised format was introduced almost 20 years ago and provides a simple, yet information-rich way for those involved in an accident to provide comprehensive details of what happened. It gives them the opportunity to do so while evets are fresh in their minds and in a factual way that avoids getting bogged down in questions of blame or admissions of liability.

That’s good news for drivers, but phrases like “simple” and “information rich” are also music to our ears when it comes to automating the assessment and review of these forms. The tool we have developed is able to read every area of the European accident form, including both the checkboxes and the free text descriptive fields.

Saving time and reducing costs

The checkbox identification provides 90 percent accuracy in identifying which boxes have been ticked. This alone allows for most of the entire claim review process to be automated, as there are a total of 500 checkbox combinations that effectively mean the claim is OK to pay out with no need for further analysis. This assessment takes an average time of 15 minutes when performed manually, but can be done in seconds using Blockclaim’s ML technology.

Enriching the data in the automotive sector

However, that is not where our involvement ends. In the event that the claim does not fall into one of these “easy” categories, further automated assessment can be carried out. The software moves on to the free text fields in the rest of the form to get a better idea of the circumstances giving rise to the claim.

This data enrichment is the most exciting part of the project, and it is here that there is so much potential that we are just beginning to tap into. As things stand, we can automate the next level of pre-qualifying checks that would ordinarily be performed manually after the checkbox review. This second-stage automation means claims being either approved or escalated to the fraud team as appropriate.

The time and money saved here is obvious. But the best is yet to come. With every form that is reviewed and text field absorbed, the software adds a little more historical data and experience to its own knowledge. This means that just like a human claim assessor, the more claim forms it sees, the better it will get at spotting ones that need a second look and are potentially fraudulent. The difference is that it can do it faster than the human brain could conceive, and it will never make a blunder through being tired or distracted.