AI powered technology automating the claims process from end to end

Integrates easily with your existing claims management system.

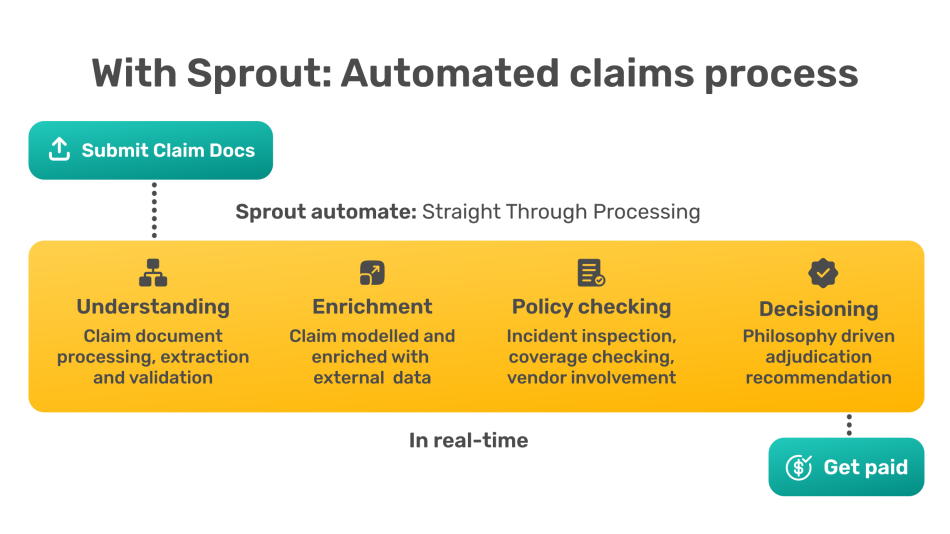

How Sprout.ai processes claims from FNOL to predicted settlement

The average claim takes 25 days to settle manually.

With Sprout.ai, claims can be settled in real time. Claim handlers can focus on customer service and more complex claims.

Sprout.ai reads, extracts, verifies and cross-references claims evidence and policy data, then makes an informed recommendation.

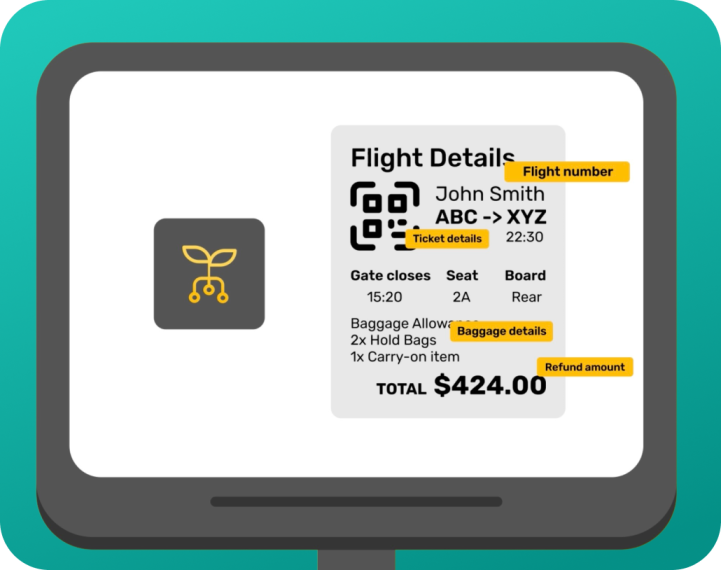

Extraction

Natural language processing (NLP) and patented optical character recognition (OCR) technology, optimised for claims, extract all relevant information from any type of document. From PDFs, to images to handwritten notes in Japanese, Sprout.ai can understand it. Generative AI produces synthetic data to train models.

Enrichment

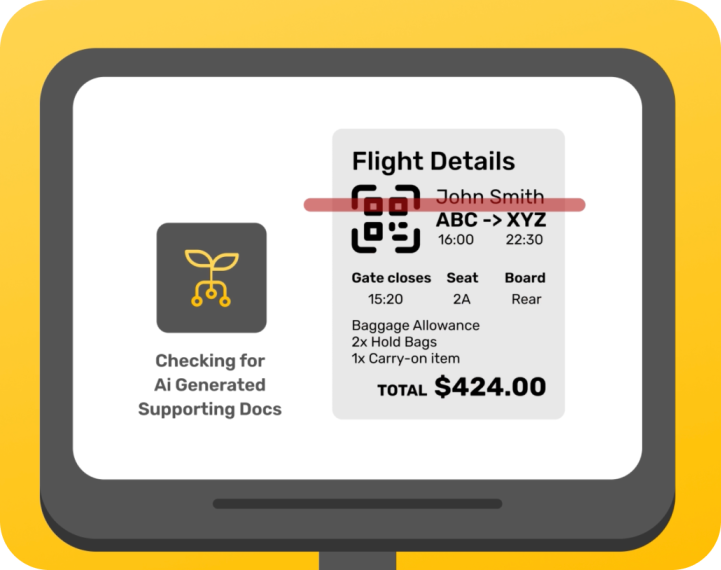

Sprout.ai validates claims, checks for fraud, reduces waste or abuse, and identifies outliers. It refines and improves customer data by up to 300% with GDPR-compliant external information.

Policy Checking

Natural language processing algorithms contextualise relevant data, then validate it against the policy contracts and schedules to check if the claim is covered under the customer’s specific policy. Limits, excesses, inclusions and exclusions are automatically calculated.

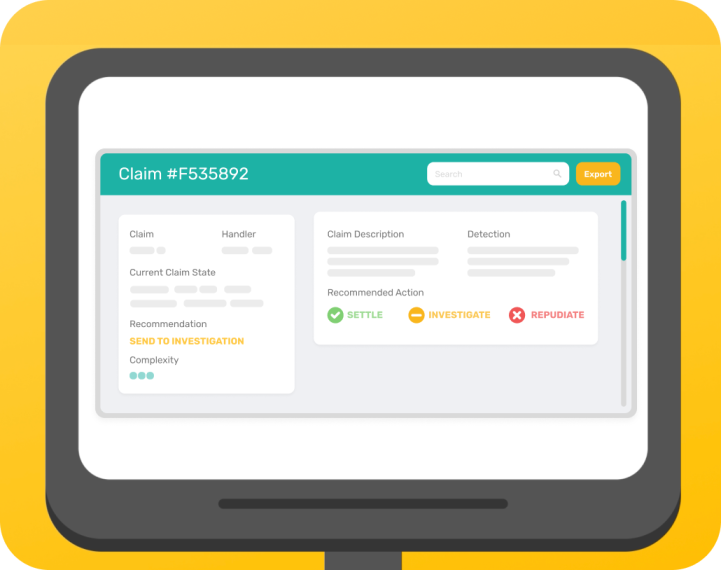

Prediction

Deep learning algorithms use your claim handling philosophy to deliver the best possible outcome for the insurer and customer, with 98% accuracy. Claims handlers can focus on complex claims that require a human touch and high levels of expertise.

Insurers using Sprout.ai settle over 50% of claims in real time.

Data from surveys conducted for Sprout.ai.

Book a demo with an expert in AI for insurers

Boost customer experience and improve operational efficiency with automated claims processing.