In our recent research report Customer Experience: The Claim Handler’s Perspective, we asked dozens of pet insurance claims handlers about the challenges they face on a daily basis, the factors that delay processing, and what their customers want.

While sharing many characteristics with other insurance types, pet claims present specific challenges when it comes to document handling, communication, and process efficiency. Addressing these areas can lead to more efficient operations, improved customer satisfaction, and a happier workforce in the pet insurance sector.

Challenges faced by pet claims handlers

Operations

Customer communication

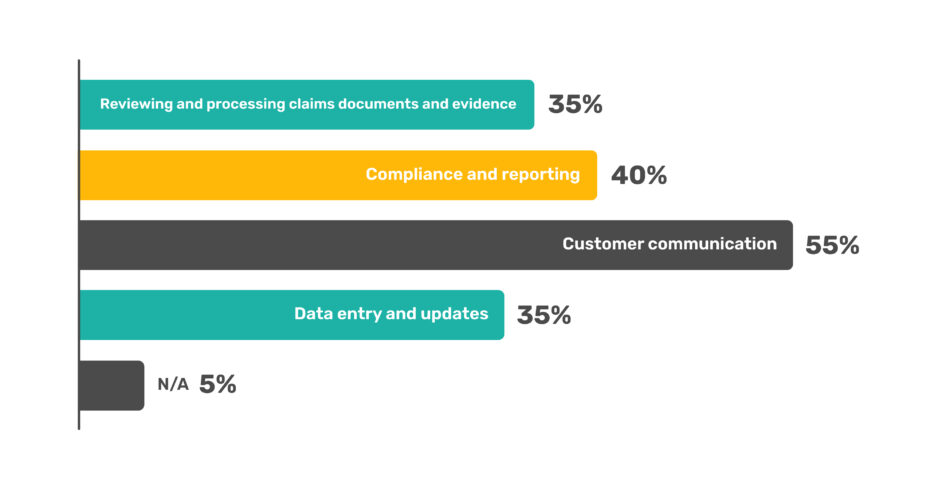

55% of pet claims handlers often find communication with customers demanding.

Document handling

35% of pet claims handlers say a significant amount of time is spent managing claims documents.

Compliance and reporting

40% of pet claims handlers say this is cumbersome. This is a lower figure than in more heavily regulated lines like life or health insurance, indicating simpler processes.

Challenges in claims processing

Delays from inadequate information

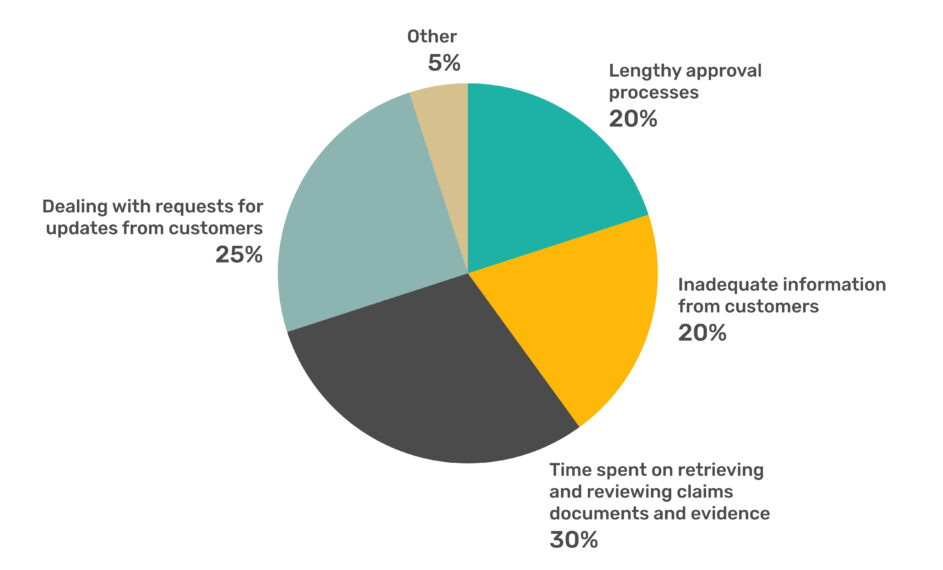

20% of pet claims handlers say this is a problem.

Lengthy approval processes

20% of pet claims handlers say this is a problem. Although this rate is lower than in other lines, there is still room for improvement.

Areas for improvement

Reducing manual tasks

55% of pet claims handlers desire fewer manual tasks,such as data entry, claims updates, and standard customer responses.

Customer feedback

Complaints about delays

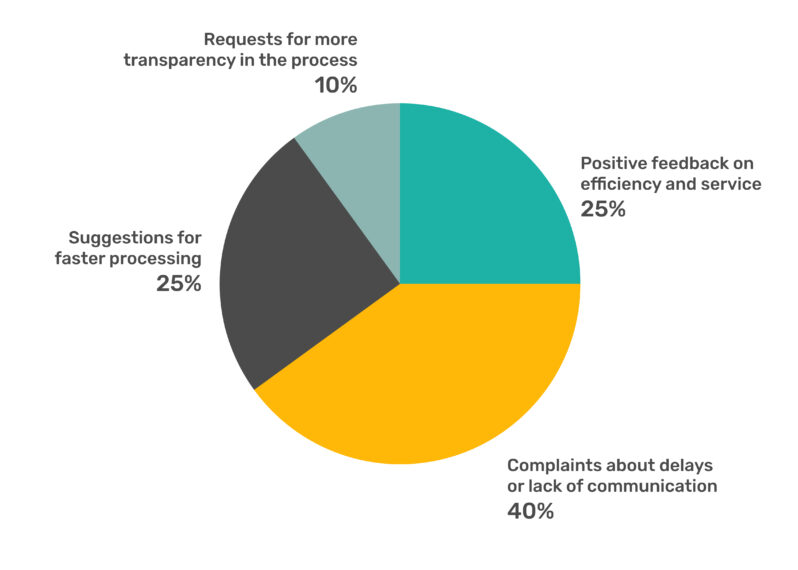

This is one of the most common types of feedback, with 40% of pet claims handlers saying they received it.

Improving customer satisfaction

Speeding up the claims resolution process was the most cited way to improve customer experience, according to claims handlers.

Read more: Pet claims in 2024 | Download the guide

Why pet claim processing can be automated

Automating pet claim processing is often easier than other insurance lines due to several key factors:

1. Standardised claims: Pet insurance typically covers routine and less complex procedures, making the claims more standardised and easier to automate.

2. Lower financial stakes: The amounts involved in pet insurance claims are generally lower, reducing the risks associated with automating claims processing.

3. High volume of claims: Pet insurance frequently deals with a high volume of low-value claims, which are ideal for automation to improve efficiency and accuracy.

4. Digital-savvy customer base: Pet insurance customers often expect quick, digital-first services, making automation a strategic fit for enhancing customer satisfaction.

5. Less regulatory complexity: Pet insurance is not as heavily regulated as life or health insurance, allowing more flexibility to implement automated processes.

6. Data uniformity: The data involved in pet insurance is often uniform, facilitating easier integration into automated systems.

How Sprout.ai helps claims handers and improves customer experience

Sprout.ai uses advanced artificial intelligence technologies, such as optical character recognition (OCR) and natural language processing (NLP), to dramatically enhance the speed and efficiency of pet insurance claims processing.

By automating the claims handling process from first notification of loss to suggested settlement, Sprout.ai significantly reduces the time required for claims to be reviewed and approved. In fact, many claims can be settled in minutes.

This accelerated process minimises the need for repeated customer interactions, as the system quickly and accurately extracts and verifies information from the outset.

As a result, claims move swiftly through to the approval stage, drastically cutting down wait times and reducing the frequency of follow-up queries from customers.

This not only improves the efficiency and accuracy of claims handling but also enhances overall customer satisfaction by providing quicker resolutions and reducing the likelihood of errors and delays.

Claims handlers can focus on more complex cases and customer interactions that require a deeper level of personal attention.

Here’s how Sprout.ai solves each of the pain points identified in the pet insurance claims handling process:

1. High volume of customer communications

By automating classification, data extraction, policy checking, and claim assessment, Sprout.ai minimises the need for repeated customer interactions. The system’s efficient handling from the outset dramatically cuts down on the volume of communications required, addressing the tedious aspect of customer communication by providing faster and more accurate responses. As claims are settled faster, claims handlers need to send fewer questions about missing information or answer requests for updates.

2. Complex compliance and reporting

Sprout.ai ensures detailed and accurate data extraction and cause analysis, which simplifies compliance and reporting tasks. Since the AI accurately extracts and classifies data from documents and checks against policy terms, compliance with regulations is streamlined, reducing the time and complexity involved in manual compliance tasks.

3. Tedious claims processing

The automation of document processing through OCR and NLP technologies significantly reduces the time spent on data entry and document review. By swiftly classifying claims and extracting data, Sprout.ai lessens the manual workload, allowing claims to be processed more quickly and with fewer errors. The system can process both structured data, such as forms, and unstructured data, such as handwritten receipts, in many languages. This directly addresses the issue of tedious document processing and data entry.

4. Slow claims processing

Sprout.ai tackles delays caused by inadequate information and lengthy approval processes by automating the inclusion and exclusion checking and ensuring comprehensive assessments of claims through detailed AI analysis. The system’s ability to quickly verify claim validity and accurately assess the nature and severity of claims speeds up the approval process and reduces the time spent retrieving and reviewing documents.

How Sprout.ai processes pet claims

Sprout.ai uses your claim handling philosophy to deliver the best possible outcome for the insurer and customer, with 98% accuracy, often in seconds. Claims handlers can focus on complex claims that require a human touch and high levels of expertise.

1. Claim classification

The claim is initially classified to understand its nature. For example, in the case of a pet insurance claim, it might involve an incident such as a pet injury, illness, or accident. This step sets the stage for detailed investigation and flags any missing information that may be crucial for processing.

2. Cause analysis

The cause of the claim is thoroughly analysed. For instance, if the claim is for a pet injury, the analysis will determine whether the injury was due to an accident during a routine walk, an encounter with another animal, or possibly an injury sustained at home. This helps in establishing liability and understanding the context of the incident.

3. Assessment

The severity of the injury or illness is assessed. This includes evaluating the required treatments, potential for long-term health impact, and whether the situation requires immediate medical intervention or can be managed with ongoing care.

4. Inclusion checking

The claim is then checked for coverage under the customer’s specific pet insurance policy. This involves verifying policy details to ensure the incident is covered. Verification can be conducted through a digital policy administration system or by using Natural Language Processing (NLP) to interpret the terms directly from the policy document.

5. Exclusion verification

Potential exclusions are reviewed to ascertain if the claim falls under any policy exclusions. This step is crucial to ensure that claims are not wrongfully processed or denied. Like inclusion checking, this can be achieved via a digital system or through an NLP review of the policy document.

6. Special terms

Any special terms related to the policy are examined. These might include unique inclusions or exclusions that are not typically covered in the standard policy language and are often stored in an unstructured format. This examination ensures all conditions and clauses of the policy are considered and can also be facilitated through digital systems or NLP.

7. Settlement calculation

Finally, the appropriate payment is calculated based on the outcomes of the above steps. Advanced deep learning algorithms can be employed to align the settlement with the insurer’s claims handling philosophy, ensuring accuracy and fairness in the compensation provided. This technology allows claims handlers to allocate more time to complex cases that require detailed attention and expert judgement.

Conclusion

Sprout.ai solves the common pain points in pet insurance claims handling. Through advanced AI technologies like OCR and NLP, it effectively addresses issues related to high volumes of customer communications, time-consuming claims processing, and frequent delays in processing claims.