In our recent research report Customer Experience: The Claim Handler’s Perspective, we asked travel insurance claims handlers about daily challenges, factors delaying processing, and customer needs.

We found that travel claims involve unique challenges, such as high customer interaction, complex documentation, and lengthy approval processes. With the right technology, these challenges can be addressed, leading to more efficient operations, improved customer satisfaction, and a happier workforce.

The unique challenges of travel claims processing

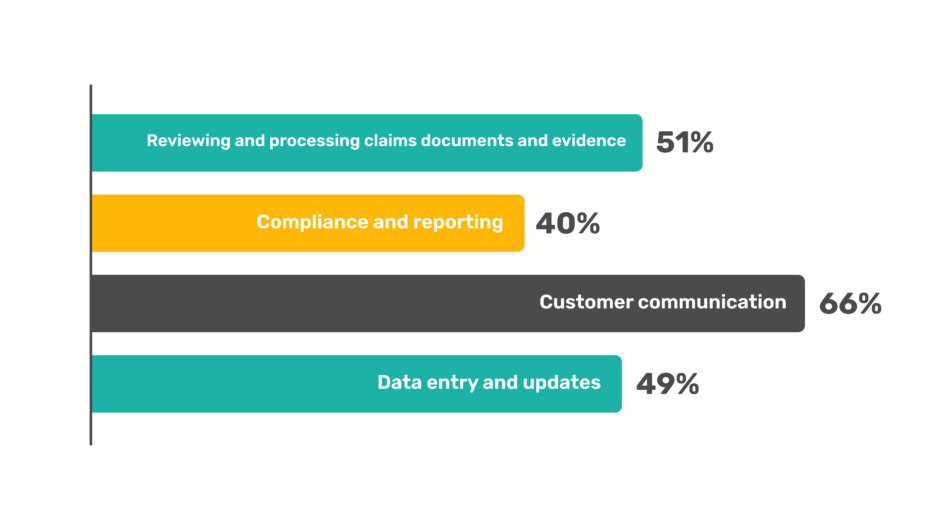

Customer communication

Travel claims require extensive customer interaction. Our survey revealed that 66% of respondents find this tedious, involving complex scenarios and frequent follow-ups, which are time-consuming and frustrating.

Reviewing and processing claims documents

51% of respondents find document review and processing to be a major pain point. The diverse and often international nature of travel incidents means handling various documents, from tickets and receipts to medical reports. Ensuring the accuracy and authenticity of these documents is time-consuming.

Data entry and updates

49% of respondents expressed frustration with data entry. Managing extensive data associated with travel claims, including multiple touchpoints and varied documentation, can lead to errors and delays if done manually.

Factors contributing to delays in travel claims

Lengthy approval processes

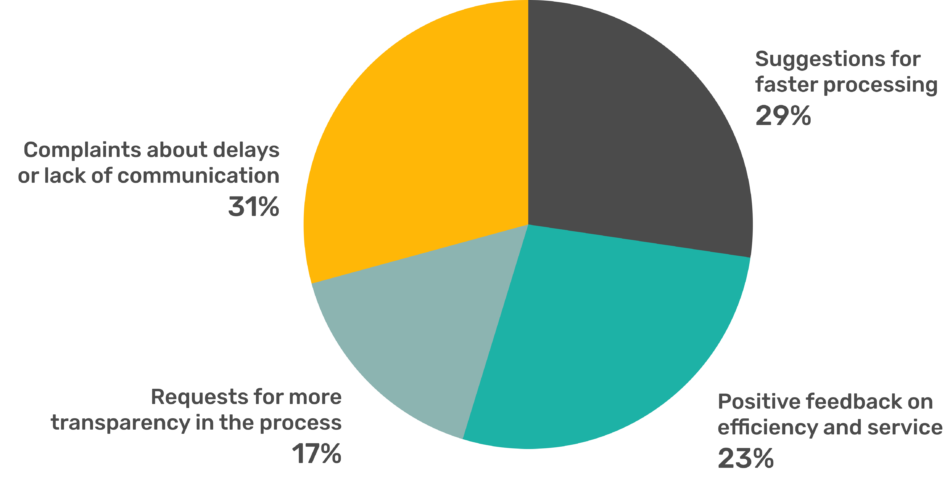

31% of respondents cited lengthy approval processes as a major delay factor. The complexity of travel claims necessitates thorough reviews, leading to slower processing times.

Inadequate information from customers

29% highlighted inadequate information from customers as a significant delay factor. Gathering complete and accurate details can be challenging, especially in stressful travel situations or with language barriers.

Time spent on retrieving and reviewing documents

26% of respondents pointed to this as a delay factor. The manual effort involved in retrieving and reviewing diverse documentation significantly contributes to processing times.

Enhancing job satisfaction

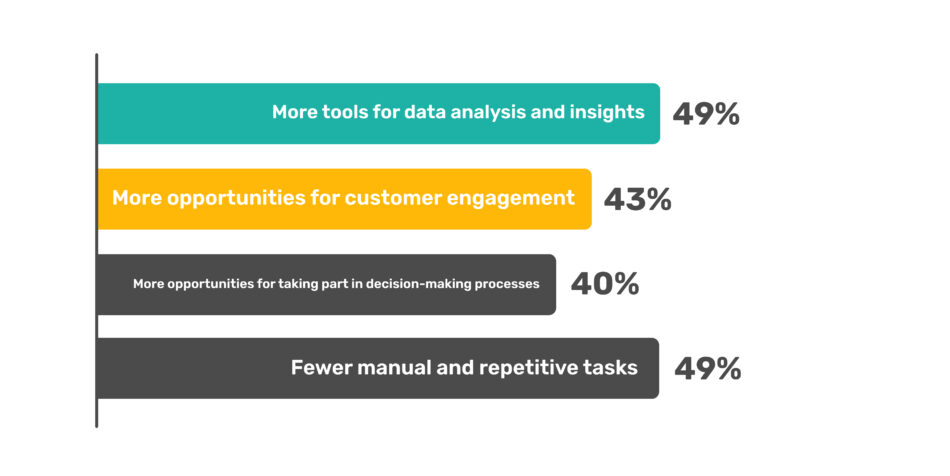

More tools for data analysis and insights

49% of claims handlers believe better data analysis tools would greatly enhance their job satisfaction.

Fewer manual and repetitive tasks

Another 49% desire fewer manual tasks.

Improving customer satisfaction

Faster resolving of claims

34% of respondents believe faster claim resolution is key to improving customer satisfaction.

Automating the claims process

34% see automation as a major improvement area. Implementing automated workflows reduces manual effort, resulting in quicker and more accurate outcomes.

Transparency in the process

29% of respondents noted that customers frequently request more transparency.

Why travel claims are suited for automated claims processing

Travel insurance claims present unique challenges that make them particularly suited for automated processing. Automation can enhance efficiency, accuracy, and customer satisfaction by managing complex data and frequent customer interactions.

Travel claims involve a diverse range of documents and data points:

- Claims require the verification of multiple documents like flight tickets, hotel receipts, medical reports, and police reports.

- Claims handlers interact with customers, travel agencies, medical facilities, and law enforcement.

Read more: How Sprout.ai can help you unlock the potential of your claims department in 2024

The benefits of automating travel claims processing

Efficient data handling: Automated systems quickly scan, verify, and process large volumes of documents.

Error reduction: Automating data entry and validation minimises the risk of human error.

Reduce customer communication needs: Frequent updates and complex scenarios require detailed explanations and clarifications. Faster processing means fewer queries.

Clear information from the start: Automation ensures that any missing information is identified and communicated promptly.

Streamlined workflows: Automated systems streamline approval workflows and track progress in real-time.

Faster resolutions: Automating routine checks and approvals reduces processing time.

Fewer challenges in information gathering: Incomplete submissions and language barriers can complicate communication and information gathering.

Intelligent data extraction: AI can extract and interpret data from documents in various languages.

How Sprout.ai Processes Travel Claims

Sprout.ai uses your claim handling philosophy to deliver the best possible outcome for both insurers and customers, achieving 98% accuracy often within seconds. This allows claims handlers to focus on complex claims that require a human touch and high levels of expertise.

1. Claim classification

The claim is initially classified to understand its nature. For example, in the case of a travel insurance claim, it might involve incidents such as trip cancellations, lost luggage, medical emergencies abroad, or travel delays. This step sets the stage for detailed investigation and flags any missing information that may be crucial for processing.

2. Cause analysis

The cause of the claim is thoroughly analysed. For instance, if the claim is for a medical emergency abroad, the analysis will determine whether the emergency was due to an illness, an accident, or other unforeseen event. This helps in establishing liability and understanding the context of the incident.

3. Assessment

The severity of the incident is assessed. This includes evaluating the required treatments for medical claims, the extent of delays or cancellations for trip-related claims, and the value of lost or damaged items for luggage claims. This step ensures that the claim is accurately quantified and that necessary interventions are identified.

4. Inclusion checking

The claim is then checked for coverage under the customer’s specific travel insurance policy. This involves verifying policy details to ensure the incident is covered. Verification can be conducted through a digital policy administration system or by using Natural Language Processing (NLP) to interpret the terms directly from the policy document.

5. Exclusion verification

Potential exclusions are reviewed to ascertain if the claim falls under any policy exclusions. This step is crucial to ensure that claims are not wrongfully processed or denied. Like inclusion checking, this can be achieved via a digital system or through an NLP review of the policy document.

6. Special terms

Any special terms related to the policy are examined. These might include unique inclusions or exclusions that are not typically covered in the standard policy language and are often stored in an unstructured format. This examination ensures all conditions and clauses of the policy are considered and can also be facilitated through digital systems or NLP.

7. Settlement calculation

Finally, the appropriate payment is calculated based on the outcomes of the above steps. Advanced deep learning algorithms can be employed to align the settlement with the insurer’s claims handling philosophy, ensuring accuracy and fairness in the compensation provided. This technology allows claims handlers to allocate more time to complex cases that require detailed attention and expert judgement.

Read more: The top challenges in pet claims processing, and how to solve them

Conclusion

Sprout.ai streamlines travel claims processing, ensuring quick, accurate, and fair settlements.

By automating routine tasks, Sprout.ai allows claims handlers to focus on more intricate aspects of claims, improving efficiency and customer satisfaction.

Discover how Sprout.ai can revolutionise your travel claims processing and boost customer satisfaction.